by Peter Jackson, Vice President, Finance – FP&A and M&A, and Randy Dacus, Director of Customer Financial Services, Lennox International, Inc.

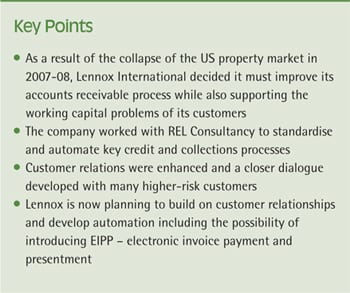

The collapse of the United States property market in 2007-8 had major implications for Lennox, with a rapid decline in construction. Dealers selling to a mixed market quickly felt the pinch, following a number of benign years for the housing and construction market. Credit and collections had not been a major area of focus for us over this period, but we realised that to position the business successfully within a radically different economic climate, we needed to improve accounts receivable performance whilst also supporting our customers who were struggling to manage working capital.

An independent approach

We had met REL Consultancy, a division of the Hackett Group, at a conference, and discussed best practices in credit and collections. We liked REL’s structured, results-led approach, so we invited them to perform an independent assessment of our credit and collections process and identify opportunities for improvement. Their assessment concluded that we could make considerable improvements by standardising, simplifying and automating key credit and collections processes, but without compromising our ability to put in place bespoke arrangements for key clients. We therefore worked with REL to map out a project plan for rapid delivery given the challenging business environment we were facing, with a view to implementing best practices in a manner that was scalable, automated and would meet Lennox’s future needs.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version