by François Masquelier, Head of Corporate Finance and Treasury, RTL Group, and Honorary Chairman of the European Association of Corporate Treasurers

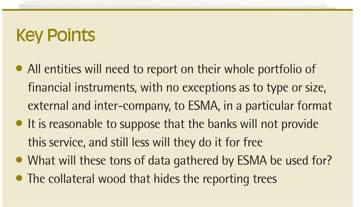

Surely the problem of the ‘collateralisation’ requirement (via CCP) under EMIR is the wood for which we cannot see the trees of the reports and confirmations that we have to issue? Everything leads us to think that, since everyone’s mind is so focused on the cash collateral to be provided, they forget that, as of September, they need to be ready to report all their financial instruments. Some people are going to be very surprised and caught off balance, you can be sure of that. Technology and automation will be needed to cope with it. Hurry up and ensure that you are in a position to comply!

The wood that hides the trees

Because of being so focused on posting cash collateral (which frightened more than one treasurer and for which exemption has been obtained), people have forgotten about preparing themselves for the reports to be issued from September for certain instruments (e.g., credit and interest rate instruments). Obviously, we still have to make sure that the final CRD IV retains the exemption obtained under EMIR, failing which that initial fear will come back to haunt the minds of treasurers. This risk should not be ruled out given certain reactions from American banks that are hostile to some measures proposed by the EU. We will stop being Doubting Thomases when we see the final published document. We remain confident, but cautious, because nothing is yet final.

However, even if we are exempted from posting collateral to provide security for valuation differences (i.e., ‘mark-to-market’ differences), we still have the obligation, with no exemptions, to report all these instruments to ESMA with no minimum limit to the authority set up for that purpose. This will most likely be done via a trade repository (TR), a sort of data collection and formatting intermediary. Furthermore, there is an obligation to mitigate risk through providing electronic confirmations within very short deadlines of mark-to-market revaluations and portfolio reconciliations. That’s all, just that!

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version