by Michael Bellacosa, Managing Director, Group Head of Global Payment Services Product Management, BNY Mellon Treasury Services

Today many large, medium-size, and small companies are looking across borders for new opportunities. Faced already with expanded competition and intensified cost cutting, the business growth of these companies should not be further hampered by the cost and inconveniences of making and receiving payments.

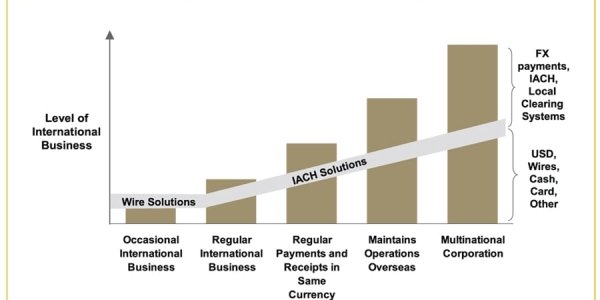

The first decade of the 2000s saw much upheaval and change. Despite the current cloud of the worldwide recession shadowing the global economy, international trade continues to develop;[1] capital flows have reversed direction as investment opportunities have emerged in new economies and in the fast-recovering Asian region; and government and industry-led initiatives have instigated far-reaching changes in regional harmonisation and standardisation of payments. Accordingly, banks and corporations are working through the uncertainties of the current market and trying to position themselves for future growth. In the US market, on which this article focuses, we believe such future expansion will be accomplished only by achieving an optimal capabilities balance among multiple types of cross-border payments.

The economy today

The complexities of implementing payment practices worldwide pose challenges to firms doing business globally.

Since 2008, the global market has been encumbered by the credit crunch and the crash of the US housing market. Worldwide dampening of market activity and consumer confidence followed, as did a rise in government deficits and borrowing and a decline in the value of the US dollar. As a result, the US and other nations have tended to retrench and turn towards protectionist policies. Fortunately, market forces have diminished the effectiveness of this reaction, and companies increasingly realise that their best chance of improving operations, reducing costs, and building new revenue sources is through foreign trade.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version