by Rajkumar Varahagiri, Business & Systems Transformation Lead, Brocade

Key Challenges

- Manual, antiquated, duplicate and inefficient cash processes across all functions

- Excessive reliance on banking portals resulting in excessive bank fees and high cost structure to maintain each bank portal

- Multiple unique point-to-point system interfaces with banking partners resulting in high IT maintenance costs and limiting the capability to scale in the future

- Decentralised and desktop storage of banking data inhibits bank data search and exposure to confidential cash activity

- High volume of manual journal bookings and increased period close cycle time

- Bank-owned solutions and proprietary file formats are now proving to be a cost burden and hindrance to scale or switch banking partners

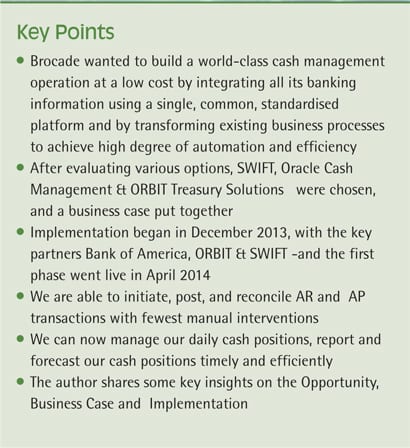

Our aim is to adopt the world class cash management process, with the most efficient use of bank services and IT.

Opportunity

As Brocade’s cash flows grow steadily in the US and overseas, it faces more and more complex issues and new challenges every day in cash management activities. The company needs to rein in the disparate cash management activities and automate a structured business process to continuously improve the management of its bank balances and transactions.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version