by Bengt Elvinsson, Assistant Treasurer – Global Operations, Corning Inc.

Corning Incorporated is the world leader in speciality glass and ceramics. Established in 1851, and headquartered in Corning, New York, Corning employs around 24,000 individuals worldwide. The company creates and makes keystone components that enable high-technology systems for consumer electronics, mobile emissions control, telecommunications and life sciences. 2007 revenues exceeded $5.8bn with net income of $2.15bn

In late 2005 we embarked on a project to centralise our banking in Asia and EMEA through a regional banking structure…

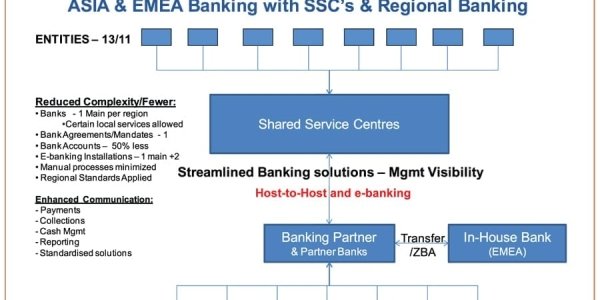

In late 2005, we embarked on a project to centralise our banking in Asia and EMEA through a regional banking structure, a project which took place alongside the implementation of shared service centres (SSCs) in Shanghai for Asia and Budapest for EMEA. The Shanghai SSC initially covers China, Hong Kong, Japan, Taiwan, Korea, Philippines and Singapore and will potentially support operations in India, Thailand and Australia in the future. In Europe, the SSC in Budapest caters for business needs in UK, Netherlands, Germany, France, Spain, Italy, Turkey, Poland, Ireland and Hungary and its scope could potentially extend to Denmark, South Africa, Russia and Luxembourg in the future. While material internal efficiencies were achieved through the creation of the SSCs, many of the potential transaction processing efficiencies were being hampered through the lack of a cohesive approach to banking in these regions. We had approximately 36 banking relationships in place with various mandates and close to 160 bank accounts. The diverse banking group also meant that a multitude of banking systems were used to communicate with our different banks for payments, collections, cash management and reporting etc. – not only were technical solutions and processes unique to each bank, but it also required more varied skill sets, per bank across the region, to correctly apply local standards and regulatory/clearing requirements. In addition, the lack of cash management cohesion meant that it was difficult to gain timely and accurate visibility over the company’s cash position, hampering our ability to manage cash related activities efficiently both locally and globally.

Regional Banking

It took some effort internally to prioritize the move to a regional banking structure. In particular, we needed to convince senior management that there would be sufficient upfront value in rationalising our banking relationships and connectivity bearing in mind we were already dedicating resources to the implementation of the regional SSCs and other key standardisation projects. Eventually, after having identified clear project objectives and both absolute and potential beneficial outcomes, the decision was made to progress the selection of preferred partner banks for EMEA and Asia to match the scope of the regional SSCs.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version