by Patricia Greenfield, Head of Treasury Operations, Astra Zeneca, and Andrew Marshall, Director, Treasury Solutions, SLG Consultants

AstraZeneca has a centralised approach to treasury management, with a team of 12 based in London. As the company has grown through merger and acquisition, treasury has had to be highly efficient and agile in order to manage additional volumes and risks. In addition to responsibility for cash, liquidity and market risk management, we also provide invoice factoring, including credit terms of up to 12 months, which adds further to the complexity of our treasury activities.

A key objective in our treasury department is to focus our expertise on activities that provide direct value to AstraZeneca. For example, we have outsourced our treasury back office to Bank of America Merrill Lynch in Dublin and the management / monitoring of critical interfaces to SunGard so that we could reduce the amount of resource that was dedicated to routine tasks. We were also looking to automate treasury processes to improve our efficiency, and enhance our reporting to facilitate better decision-making.

Legacy technology background

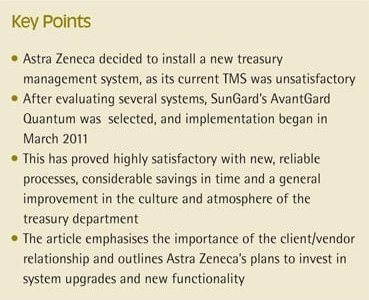

We had acquired a treasury management system (TMS) a few years ago, but the choice of solution, and implementation process had been less successful than we had envisaged. There had been insufficient investment in ongoing maintenance of the solution, both by the vendor and AstraZeneca, there was a lack of knowledge of the system within the business, and there was no engagement with the vendor, resulting in a solution that had effectively become obsolete in our treasury. Consequently, a number of treasury activities and processes were being performed manually and there was a lack of ‘operational trust’ in the TMS.

To address this, we engaged an experienced treasury technology manager. Initially, the plan was to re-engage with the vendor, place the relationship back on a positive footing, and re-implement the TMS. However, having approached the vendor, we quickly realised that this approach was unlikely to be successful, prompting us to review alternative solutions.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version