by Friedrich Floto, Senior Vice President, Finance & Administration, airberlin PLC & Co. Luftverkehrs KG

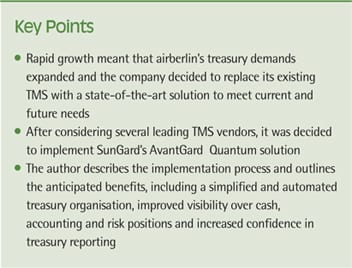

As a leading airline that has a recent history of rapid growth and an ambitious future strategy, treasury plays a vital role in supporting the financing (including aircraft financing) risk management, cash and liquidity management needs of the business. To fulfil this role, treasury needed a sophisticated treasury management system (TMS) that would support greater efficiency, automation and control, and enable the treasury team to focus on tasks that added value to the business and contributed to the group’s strategic objectives. In this article, Friedrich Floto, SVP, Finance & Administration discusses the project so far to select and implement a TMS.

Treasury organisation

airberlin has a centralised treasury organisation in Berlin. Like other airlines, overseas entities are typically small ticketing operations rather than large business functions with their own P&L so cash and treasury management requirements are largely concentrated in the centre. Within this centralised environment, we have a unique treasury organisation at airberlin. Instead of having a group treasurer, we have two SVPs responsible for different aspects of the treasury function. My colleague looks after long-term financing (including aircraft financing and leasing), trading (including foreign exchange, interest rate, jet fuel and CO2 emissions certificates) and jet fuel procurement. On my side, I take care of middle-office and back-office functions, including cash management, liquidity management, working capital, and debtor and creditor risk management. Across the two teams, we have a treasury department of around 30 professionals.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version