by Jonathan Curry, Global Chief Investment Officer – Liquidity, HSBC Global Asset Management

It is sometimes said that football (soccer) is not a matter of life or death, it’s much more important than that. Those who subscribe to this philosophy will be mourning that the World Cup is now over for another four years. Whether you’re a football fan or not, however, the four-yearly gathering of nations is a timely reminder of globalisation. For multinational businesses that are generating cash balances in many parts of the world, where cash mobility may be limited, investment strategies can no longer be restricted to the home market. Cash investment opportunities are inevitably more limited in some markets than others, so how do companies determine their choice of investment solution?

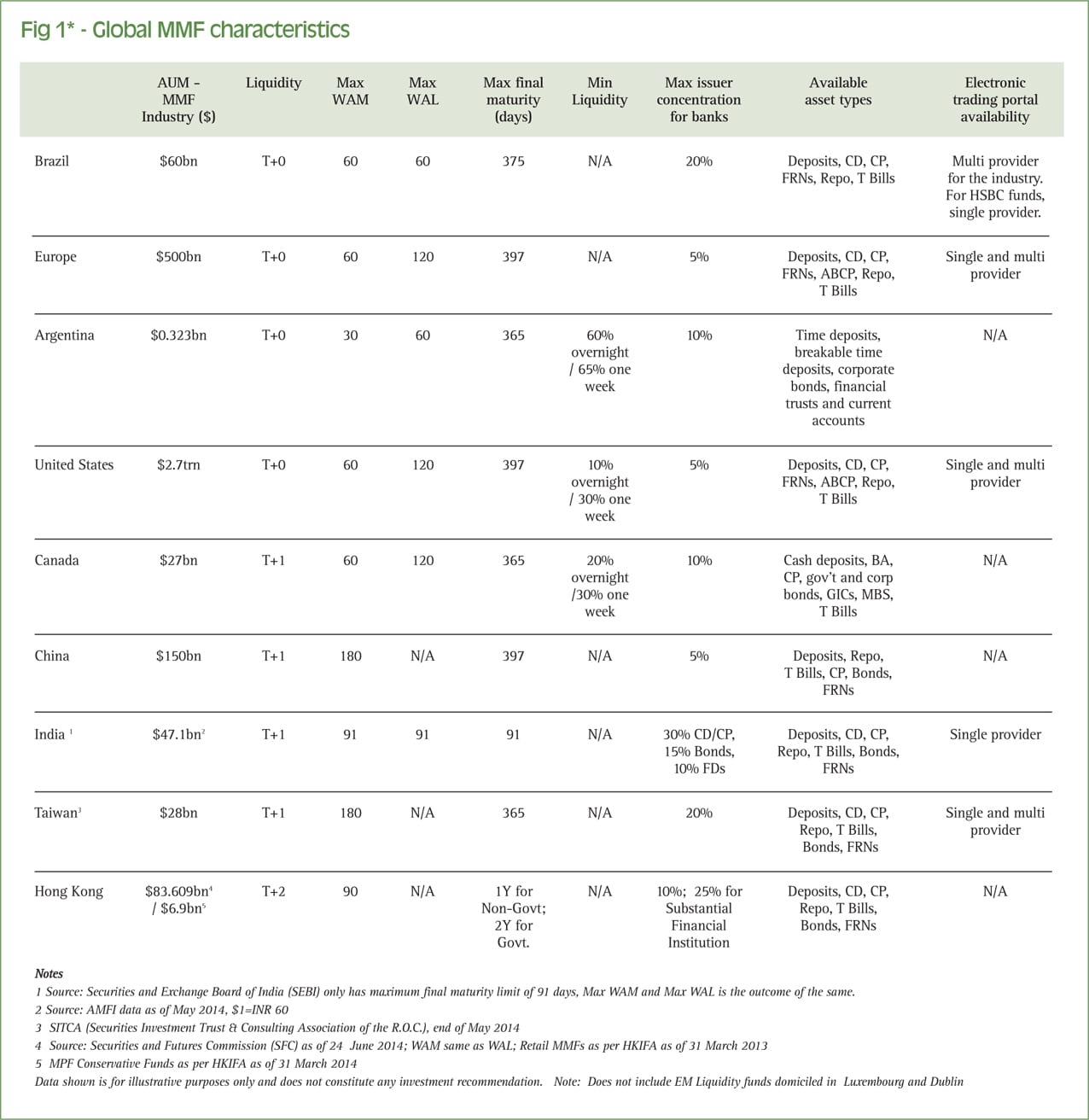

An MMF ‘league table’ of market features

Money market funds (MMFs) have become an important investment solution for short-term cash investment, particularly in the United States and Europe, but they are available in a number of other markets globally. One of the challenges when looking beyond the home market, however, is to determine the differences between these funds. In football, so long as the referee’s decisions aren’t too controversial, then whoever tops the league table at the end of a competition is usually deemed to be the best team. For MMFs, no such league table exists. The first step is to work with a trusted investment manager who understands your investment objectives and constraints in each market, has the portfolio of solutions that meets these objectives and the depth of expertise and resourcing in areas such as credit management to provide the required degree of credit, process and decision-making integrity.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version