by Bruce Meuli, Global Business Solutions Engagement Executive, Global Transaction Services EMEA, and Vincent Meier, Product Manager, Managed Treasury & Liquidity Services, Global Transaction Services EMEA, Bank of America Merrill Lynch

An in-house bank (IHB) can be the pinnacle of treasury centralisation, and more companies are choosing to take this step. However, diligent planning is required to make the implementation a success. For some companies, having a part of the structure managed by a dedicated provider can deliver further efficiency and cost benefits.

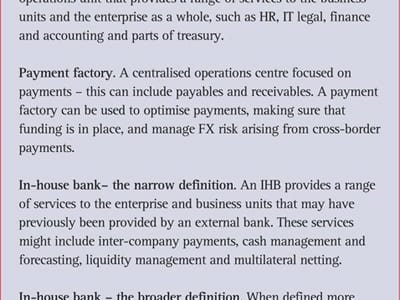

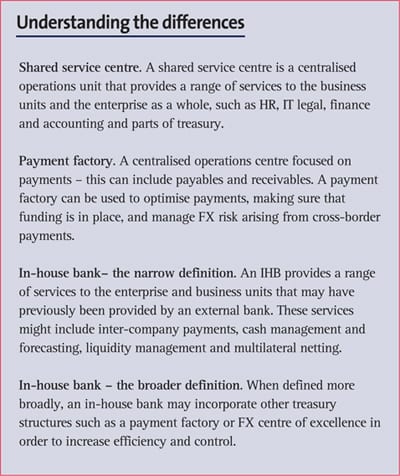

Bringing together disparate processes is a cornerstone of any efficiency drive – and a number of different tools and techniques are available which can help corporate treasurers achieve this. Where a high degree of consolidation is required, treasurers will often consider adopting a centralised structure such as a shared service centre, payment factory or IHB.

While an IHB tends to be a latter step in the maturity pathway of treasury centralisation, the operational and organisational structures that a company implements, and the order in which they do so, will be heavily influenced by a range of factors including – legal, regulatory, operational capability and business drivers. Shared service centres, payment factories, centres of excellence and/or regional treasury centres all have defined purposes. An IHB will always have a pivotal role in conjunction with these structures – either as a operational centre which has direct responsibility for some of these other structures, or as a key enterprise partner.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version