by Andrea Almeida, Head of Global Risk Management, Vale

Vale has been showing strong growth through its big pipeline of projects and some acquisitions. In 2004, the company decided to implement a risk management strategy that should encompass the integrated view of risks for the company including market, credit and operational risks. The decision to implement such strategy was in line with the goal to become one of the top leaders in the diversified mining business.

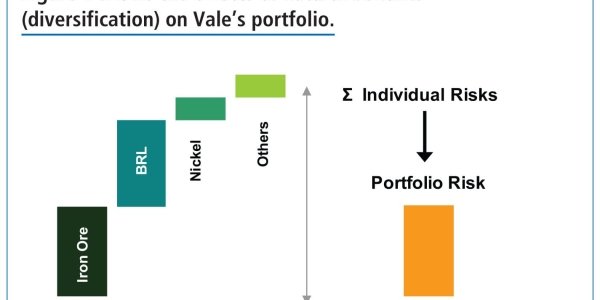

Vale is exposed to all possible kinds of risk. All the changes in the portfolio of assets over time and in the market place environment brought more volatility to its cash flow and this was one important driver to the development of the risk management practice and culture at Vale. Besides that, compliance and increased transparency on corporate governance were the other objectives to implement the risk management strategy.

The changes in governance

In 2005, the process of building the risk management governance to support the risk management activities started. The bylaws of the company were changed to incorporate as a responsibility of the board of directors the approval of risk management policies, and the Executive Risk Management Committee was created to support the Executive Board (Executive Management Team) on decision-making. The risk management policy was approved and as part of the responsibility guidelines, the Board of Directors delegated the power of decision-making on risk management to the Executive Board. Continuing this process, the market risk management norm and a credit risk management norm (policy and procedure) were designed and approved by the board of directors. Some years later the operational risk management norm was also approved. These are the governance documents that support the risk management process, defining responsibilities between the risk management area and the other business processes at Vale.

Development of market risk stream

Market risk was the first focus of the risk management area, and the idea was to create a framework that would support decision-making in the company. The first important decision was the choice of the objective function of risk management, and there were three alternatives at the time: cash flow, earnings or value. The decision was made for cash flow, in line with the idea that the worst possible problem a company could face is the lack of cash to perform its obligations and invest in growth projects. Besides that, most of the decision-making in finance was linked to cash flow such as: the amount of funding needed to support the investment plan and the minimum dividend policy that Vale designed were based on cash flow, so this was somehow a natural choice.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version