Robotic process automation has the potential to be a powerful tool for treasurers – especially those looking for new ways to garner efficiency gains. What’s more, as a relatively easy-to-deploy technology, RPA can deliver significant value in a short timeframe. But is RPA really a silver bullet for treasury? We ask four industry experts for their opinions.

Whether you’re an R2-D2, RoboCop, or WALL-E fan, stereotypical movie views of robots aren’t helpful when it comes to discussion around robotic process automation. Unlike the all-singing, all-dancing robots of science fiction, RPA is simply an automated rules-based software that executes pre-programmed tasks.

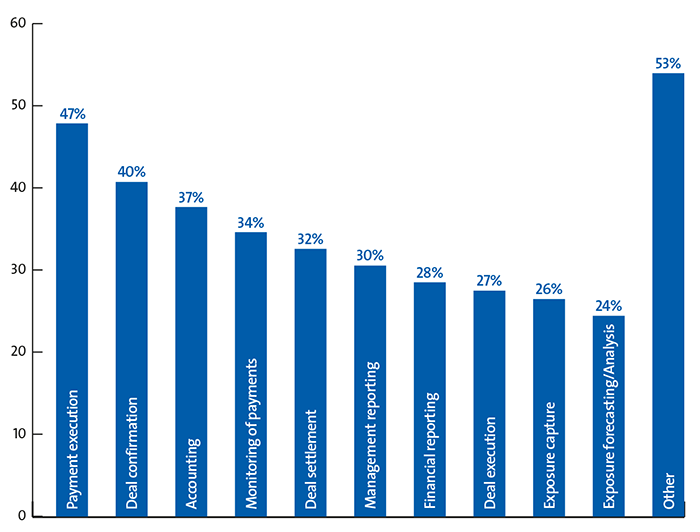

Nevertheless, RPA is making waves among the treasury community. According to PwC’s 2019 Treasury Benchmarking Survey, 47% of treasurers believe RPA will be either relevant or highly relevant over next two-to-three years. The survey also identifies interesting use cases for RPA – ranging from payment execution to accounting and management reporting (see fig.1).

Fig 1: RPA Use Cases Source: PwC Treasury Benchmarking Study 2019 Sign up for free to read the full articleRegister Login with LinkedInAlready have an account? Login Download our Free Treasury App for mobile and tablet to read articles – no log in required. Download Version Download Version

|