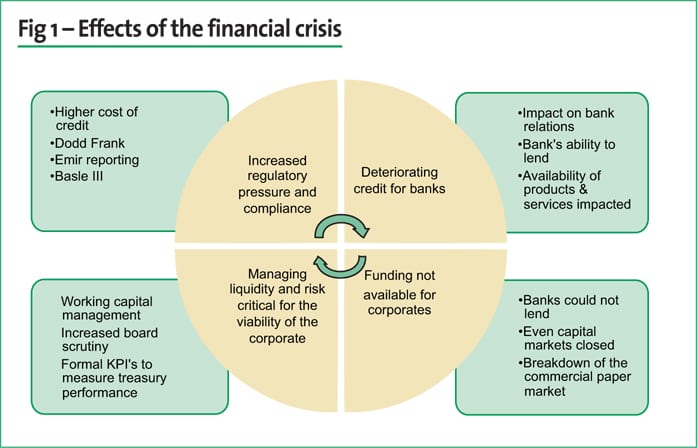

The global financial crisis had a significant impact on the corporate treasurer in terms of responsibilities and expectations. Before the crises the primary focus of the treasurer was to manage volatility and risk with regards to cash and liquidity, foreign exchange and interest rates. Over the last couple of year this role evolved from purely risk management (execution) to being a ‘partner to the business’ and having a ‘seat at the table’ with regards to strategic decision-making. This broader and more important responsibility has been reinforced by the financial crises and its impact on the corporate environment.

Some of the key lessons for the treasurer from the financial crisis include:

Strategic lessons

- Must have a group of strong, long-term, committed relationship banks

- Access to diversified funding sources is crucial i.e., bank debt, capital markets (different markets), money market, private placement, commercial paper etc.

- Raising finance can be challenging even for well-rated corporates

- Having a large liquidity buffer is prudent (cost of carry less important)

- Safety of surplus cash is more important than the yield achieved

- Major shift in risk management especially credit risk management

- Be forward looking and have an upfront plan to manage a downside (crisis) scenario

Operational lessons

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version