by François Masquelier, Head of Corporate Finance and Treasury, RTL Group, and Honorary Chairman, European Association of Corporate Treasurers

The world is changing extremely fast, particularly as a result of the recent huge strides in technology. The business model of many companies has also shifted towards B2C in parallel with it. A consequence of this fundamental transformation is that companies have to collect funds (i.e., incoming payments) using new payment methods (i.e., e-payments). They need to embrace these diverse and varied payment methods if they are to the collect funds due to this business transformation and make their new operating models viable in the long term. The difficulty often derives from the high volume of receipt transactions and their low, or even tiny, value. This throws costs and other expenses into sharp relief. These new niches are encouraging many service providers, (such as banks, e-traders, software houses, technology companies, search engines, etc.) to develop and offer alternative solutions, which are genuine competition for traditional banks. Some new entities even have banking licences, enabling them to carry out transactions which the banks themselves have always tried to shield from competition.

Without having the same regulatory and financial constraints, with shorter response times and the capacity to develop appropriate IT solutions very fast, these new players are on a course, in time, to gobble up the online payment market. A war has broken out. No one knows who will win it. We cannot say whether the banks will try to adapt their own business model, or whether e-business companies will diversify into neutral ground. But it is absolutely certain that the fighting will be fierce, and that there will be bodies lying by the wayside. The new arrivals will obviously have immeasurable advantages compared to banks – cost structure, speed of response, technology and developers, fewer regulatory restrictions, huge liquidity, etc. Furthermore, e-business companies could, and know how to, make the fullest use of customer information (i.e., bog data) to profile them, target them and finally hook them, like a skilful angler.

These electronic payment solutions exist or are being brought into existence as we speak. For them, too, size and scale will be crucial in building a business that will last. Security, interfacing, flexibility and price will be the key challenges to be overcome to be able to attract new users. The survival of e-payment companies will come at a high price. This no longer scares technology companies, which are awash with cash. The portability and mobility of payment devices and methods will be crucial advantages to be capitalised on in attracting new people to sign up. Can treasurers decide they don’t need to bother about this development, this genuine tsunami and market trend? These new ‘e-companies’ will provide access and solutions, because their very survival depends upon it.

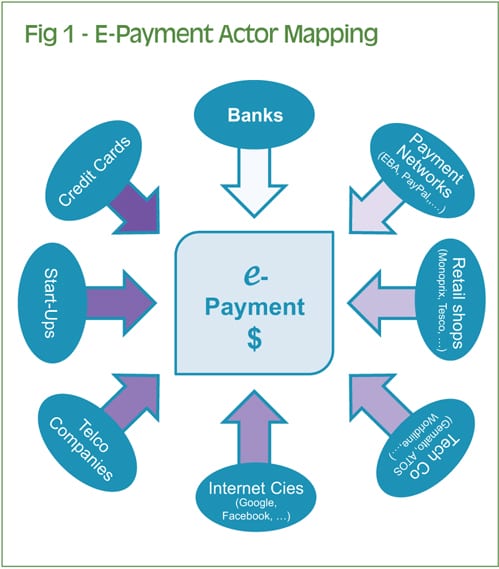

Multiple players

Click image to enlarge

Click image to enlarge

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version