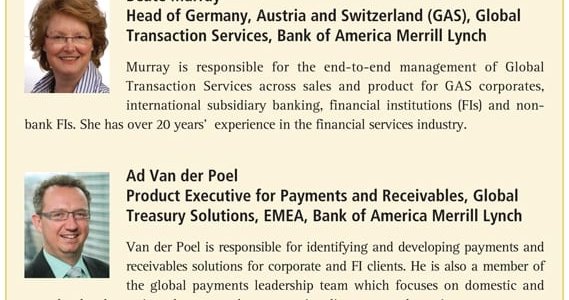

by Beate Murray, Head of Germany, Austria and Switzerland, Global Transaction Services and Ad Van der Poel, Head of Payments and Receivables for Global Treasury Solutions, EMEA, Bank of America Merrill Lynch

The mandatory move from national payments and collections instruments to Single Euro Payment Area (SEPA) instruments on February 1, 2014 offers German corporations, and multinationals based in Germany, a huge opportunity. At a stroke, many of the barriers to treasury efficiency will be removed. Moreover, from a payment perspective, companies will be able to expand as easily within the SEPA area (which includes the 27 EU members, as well as Iceland, Liechtenstein, Norway, Switzerland and Monaco) as they would domestically.

Despite these attractions relatively few companies in Germany have embraced SEPA to date. A European survey by PricewaterhouseCoopers in January shows that 21.6% of respondents have yet to define and plan their SEPA readiness activities while a worrying 43.5% of respondents that have initiated a SEPA project expect to complete it uncomfortably close to the 2014 deadline. German preparedness for SEPA is thought to be at similar levels, although many large companies have already completed their SEPA preparations.

The reluctance among many companies to respond positively to SEPA is understandable. SEPA has been discussed for over a decade, and has suffered from a lack of clarity regarding important details and deadlines, causing many companies to lose what little interest they had. Furthermore, in recent years, corporations in Europe have had more pressing concerns than SEPA given the financial crisis, the global recession and the Eurozone debt crisis.

However, the time for prevarication has passed. SEPA has a firm deadline and there is no political will to delay it. Failure to be ready will leave companies unable to make payments and collections and, therefore, unable to operate. To avoid any disruptions, companies should start working closely with their banks now to ensure they are ready for the deadline. While there has been a recent welcome rise in interest in SEPA among corporations in Germany, any company that has yet to begin planning and implementing a SEPA strategy is endangering its business. Moreover, the later such a project is left, the more difficult it will be for companies to access suitable support.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version