by Brice Zimmermann, Head, Treasury Control & Reporting and Peter Zumkeller, Manager, Finance Transformation Programme, Novartis

In 2010, Novartis embarked on a major finance transformation programme to position treasury and the wider finance function as best-in-class for the pharmaceutical industry. During the Cash Management University hosted by BNP Paribas, Brice Zimmermann and Peter Zumkeller of Novartis, shared their experiences of finance transformation.

Transformation objectives

Treasury is a corporate unit within Group Finance at Novartis, located in Basel, and divided between International Treasury, Capital Markets, and Control & Reporting. Treasury’s objective is to manage risk on behalf of the group and ensure that operating units are appropriately funded to meet their strategic and operational objectives.

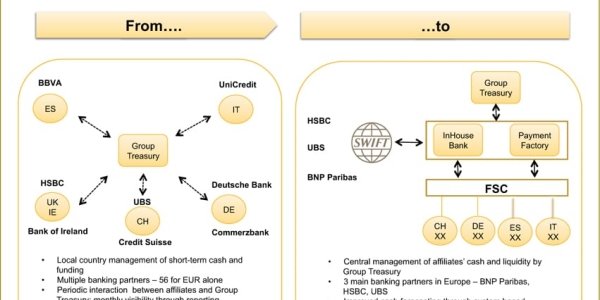

Novartis aims to be best-in-class across all of its activities, including Finance. To support this objective, we launched a finance transformation programme to optimise process efficiency, enhance the quality of business intelligence and decision-making, foster the best skills in the profession, and improve transparency and control. We identified a variety of ways in which this vision could be achieved in treasury, including the following:

- Achieve full control and visibility over financial risk at a group level

- Achieve full control and visibility over group liquidity

- Centralise cash using cash pooling wherever possible

- Rationalise cash management banks to enhance efficiency, avoid fragmentation and create economies of scale

- Streamline payments processes and infrastructure

- Introduce centres of competence within financial service centres

Ultimately, the objectives were: to standardise, simplify and automate treasury activities wherever possible.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version