by Hubert Rappold, CEO, TIPCO Treasury & Technology

Bank fee controlling is fun – how automated bank fee controlling can improve treasury operations.

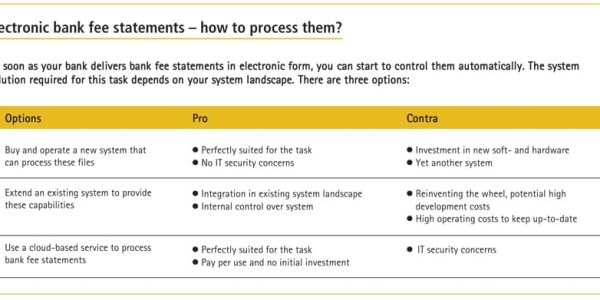

‘Fun‘ is usually not the first word that comes to mind when you think about controlling bank fees. ‘Frustrating‘ and ‘time-consuming‘ usually head the list. That is hardly a surprise given the current situation in many companies. Bank fee statements are usually paper-based and there is no information about agreed fees to facilitate comparison. Very often this task ends up with a new colleague or an intern who fight their way through stacks of paper and endless spreadsheets. Inevitably, given this approach, a professional monthly check of all fees is simply not feasible.

Why bother about bank fees?

This is rather unfortunate, since bank fee statements contain a wealth of information that can be used by the treasurer. Let’s take a look at them in turn:

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version