The UK Association of Corporate Treasurers (ACT) annual Cash Management Conference 2024 was held on 6 March at Convene in the City of London. Treasurers from Tui, S4 Capital, PPD, Rentokil Initial, and Diploma, among others, examined how treasurers are coping with recent spikes in interest rates, FX, and economic unpredictability brought about by the pandemic and geopolitical tensions.

The Covid-19 pandemic and current conflicts in Ukraine and Gaza – not to mention tensions over Taiwan – have affected the economy, supply chains, oil and other commodity prices. This has caused inflation and interest rate (IR) rises, as governments try to control rapid price and wage rises, following a long period of loose monetary policy after the 2008 global financial crisis. It’s been, and remains, a volatile time, which impacts FX, loans, hedging programmes, liquidity, and, crucially working capital. Treasurers have been challenged as never before within living memory.

There are also imminent elections in the US, where Donald Trump could make a return to the White House altering American economic policy, and polls are due in other countries. For example, a general election must be held in the UK this year. A Labour victory is widely expected.

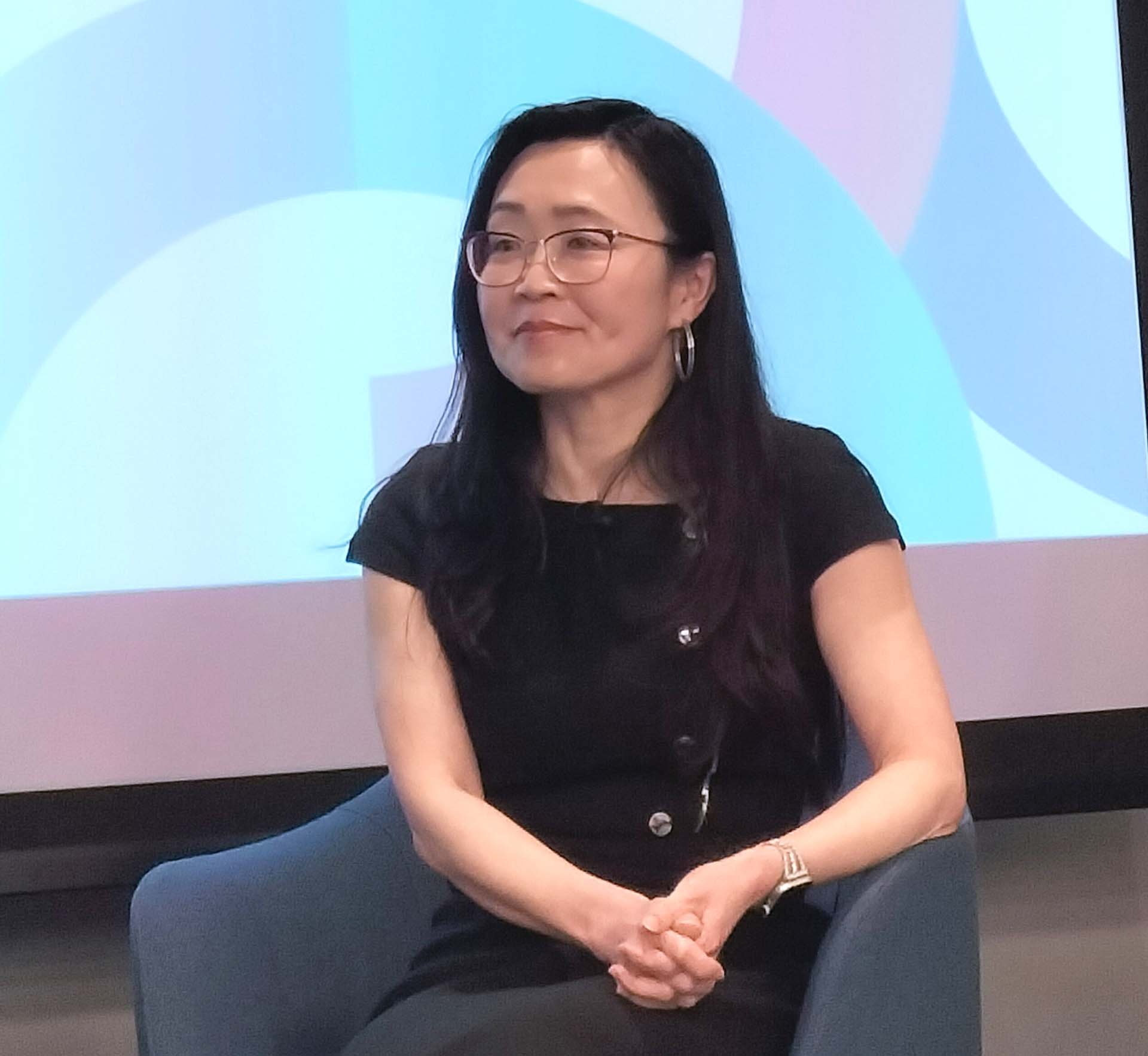

“I’ve a strong sense the markets have priced this in,” said the conference opening speaker Sonia Khan, Director of the lobbying firm Cicero, as she reassured attendees that a Labour win shouldn’t have a major near-term economic impact. Labour’s policies don’t diverge from accepted financial norms as did those of Liz Truss, who was briefly Prime Minister before Rishi Sunak’s arrival at No 10 Downing Street in October 2022. Her unfunded tax cuts caused a UK-centric spike in IR.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version