Results of an independent research project

Efficient, timely collections are a priority in every industry, and each has a different set of challenges according to collection volumes, customer base and business organisation. Like other industries, the United States insurance sector has experienced a large number of mergers and acquisitions in recent years, which can result in fragmentation of business processes. Moreover, with a large numbers of both retail and institutional customers and a very high volume of collections, the insurance sector in the United States is going through a period of significant change as electronic payment methods replace checks, and insurance firms seek new ways of ensuring process efficiency to increase their competitive advantage.

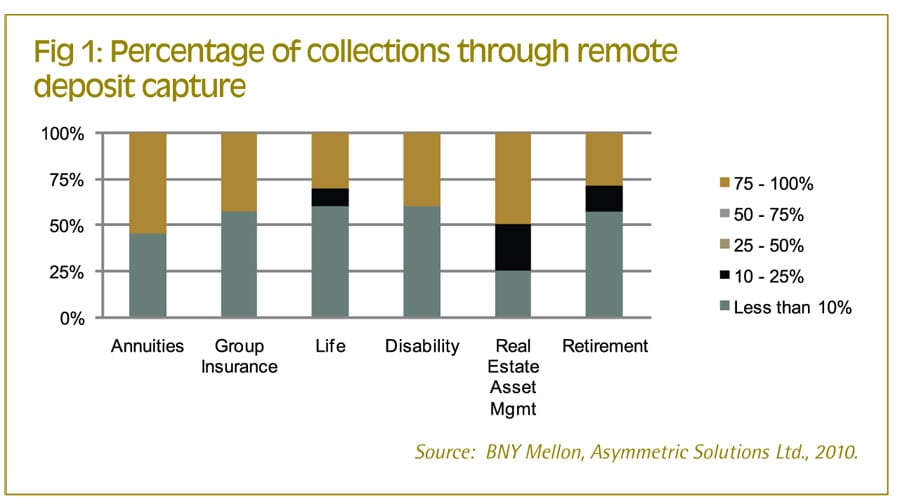

To understand some of the needs, challenges and opportunities in treasury collections amongst insurance companies more fully, BNY Mellon commissioned a research project with an independent consultancy firm, involving some of the leading insurance companies in the United States. This project revealed significant insights into the insurance segment, but many of these can also be applied to other business segments. This article highlights some of the key findings of this project.

Centralization of collections

Centralization of financial processes, including collections, has become a key theme for all industries as companies seek to maximize efficiency of processes and visibility of information. The project revealed that although ‘centralization’ is a commonly used term, it is often interpreted differently, referring variously to use of common systems/processes for collections in multiple locations, centralization of processes by business line/subsidiary, or centralization of collections into a single location based on a single technical infrastructure. Although many firms describe their collections process as ‘centralized,’ in most cases this referred to centralization by business line, with each segment organizing its collections activities independently, as opposed to having a cohesive set of collections processes in a single location.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version