by Thomas Schräder, Partner, and Thomas Hampel, Senior Manager, PwC – Corporate Treasury Solutions

Attempting to forecast their future liquidity, global corporations are increasingly challenged. Highly volatile markets, macroeconomic ambiguity and political risk in target markets are factors that boost uncertainty. In such an environment, expected revenues are likely to fail to materialise and banks as well as capital markets provide external funding only reluctantly and at high costs. Because of this, it is more vital than ever for corporations to identify internal financing capabilities and to have a clear view on their future liquidity development. Both are necessary to survive volatile economic cycles and to ensure sufficient funding to keep operations running.

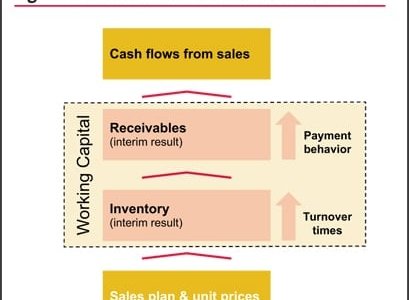

One major prerequisite for coping with these requirements is the establishment of a robust, comprehensive and reliable liquidity forecasting and reporting process. The immediate availability of validated information and transparency as to its origins are critical success factors. At the same time, flexibility in assessing, consolidating and presenting the information needs to be granted.

However, the growing complexity of business processes imposes two major challenges:

1. Implementing consistent and comprehensive horizontal data integration covering all relevant systems and business units involved in the process

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version