by Martin Böhme, Senior Manager, PwC Belgium

While supply chain finance is currently a very popular solution for many European corporates, its implementation provides many hurdles far beyond the typical scope of the treasury function. Many treasurers still see it as a single point solution, while it is actually a multi-facet challenge requiring the involvement of various functions and stakeholders. If it is not properly addressed, the programme will eventually fail to deliver the full range of benefits expected by corporates.

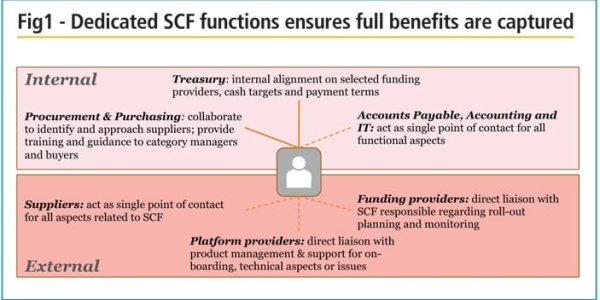

Lessons learned from supply chain finance implementations that PwC has supported over the past months show that some of the points needing particular attention are the buy-in of various functional areas, strategic drive and clarity over roles and responsibilities of the different internal and external parties involved.

Corporate liquidity is still challenged, and corporates are taking appropriate measures to optimise their working capital, as PwC’s latest European working capital study suggests [1]. However, with an overall declining days payable outstanding over five years, it also showed that the area of trade payables is still overlooked as an opportunity to optimise cash. Buyer-centric SCF programmes can be the ideal tool for this purpose, but only if the following obstacles are appropriately managed.

Consider suppliers’ markets

When selecting the appropriate funding providers for SCF, make sure to leverage sweetspot of banks. Looking only at your current relationship banks or purely from share-of-wallet considerations is only acceptable as long as these already have global capabilities and are present in the geographies from which you are sourcing. Your SCF banks should not only be the market of your buying organisation, but ideally be present in the sourcing market. To on-board a maximum of suppliers in these foreign markets, corporates will be able to benefit greatly from local bank operating staff to support the on-boarding in the local markets by speaking their language, and understanding suppliers’ requirements and needs. Secondly, performing typical procedural requirements and regulations on banks’ know-your-customer (KYC) with suppliers in remote locations adds an additional layer of complexity, and can even break the deal. Given the continuing focus on the bottom line and the growth of sourcing from emerging markets, such as Asia, the disconnect will continue to become more pronounced for many organisations.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version