by Barry Martin & Riyadh Bhyat, Debt Capital Markets, Rand Merchant Bank

Though convertible bonds have been issued on international markets for a number of years, issuers in South Africa are only now beginning to recognize their benefits, while investors are starting to understand their attractions.

Convertible bonds include both an equity and a debt component. Investors benefit from the upside potential of an equity instrument and the certainty attached to a debt instrument. The debt component of the instrument represents the present value of coupon payments and the cash redemption value while the equity option gives the convertible bond holder the right to receive a pre-determined number of shares in the underlying company (the issuer) instead of receiving future coupons and a cash redemption at maturity.

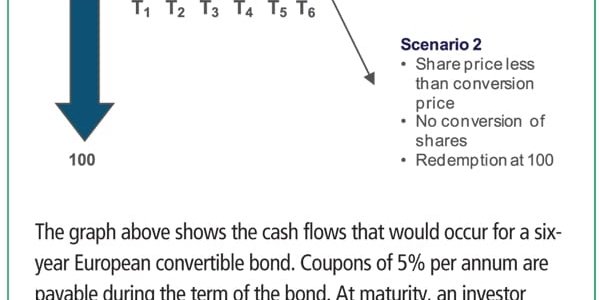

Throughout the life of the instrument, the issuer pays interest coupons to investors until either conversion to shares, or final maturity and cash redemption, occurs. At maturity, convertibles are worth either their cash redemption value or the market value of the shares into which they are convertible (see Figure 1).

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version