by Nadezhda Leitsinger, Working Capital and Treasury Manager, Kraft Foods Russia

by Nadezhda Leitsinger, Working Capital and Treasury Manager, Kraft Foods Russia

Many companies have rationalised their bank relationships in recent years with a view to managing counterparty risk more effectively, streamlining connectivity and centralising liquidity. This is easier to achieve in countries with a well-developed banking system and a culture of electronic payments than in countries at an earlier stage in the development of their financial infrastructure. In this article, Nadezhda Leitsinger of Kraft Foods in Russia outlines how the company has approached bank relationships in Russia.

Treasury organisation

Kraft Foods has a centralised regional treasury located in Moscow supporting all legal entities in Russia, including cash management operations, risk management, including FX risk and insurance, together with short- and long-term cash flow forecasting and working capital management. We manage transaction execution from treasury and act as a centre for banking relationships across the country.

Reviewing bank relationships

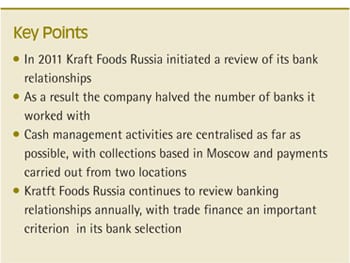

Until 2011, we had a large number of bank relationships, including both international and local banks. This made it difficult to centralise liquidity, manage our counterparty risk and achieve economies of scale. In 2011, we therefore embarked on a project to rationalise our bank relationships. We received a list of recommended banks from our global treasury team, but we were not obliged to select from these banks.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version