by Alexis Wattinne, Director, Finance and Treasury, Bonduelle

Bonduelle is a company with a strong commitment to its staff and customers, integrity and excellence across everything that we do. Treasury has a key role in supporting the company in fulfilling its objectives and enabling our businesses to focus on customer engagement and satisfaction, therefore it should not be considered as a back-office function. Consequently, we have a centralised treasury function that is structured to support the business and deliver value. This article outlines some of the ways in which we have achieved this so far, and some of our current and future plans.

Treasury organisation

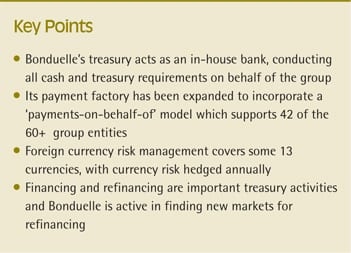

Our treasury department comprises six people, and acts as an in-house bank, conducting all cash and treasury requirements on behalf of the Bonduelle group. In this way, we maintain control over our cash, treasury and risk requirements globally, achieve harmonised financing conditions and ensure adherence with transfer pricing regulations. We use JD Edwards as our ERP across Bonduelle, a common database across the company which ensures a ‘single source of truth’ for information such as supplier settlement instructions. This is integrated with our treasury platform, Sage FRP Treasury. We use SWIFT for bank communication, which is outsourced to a service bureau.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version