by Hugo van Wijk, CEO, Vallstein, and Robert Dekker, Senior Manager KPMG, The Netherlands

An active approach to bank relationship management can have positive effects on a modern firm. With the right actions and approach buyers and sellers of financial products will benefit.

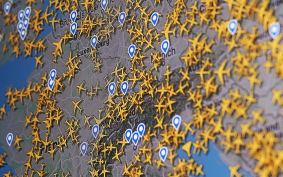

Bank relationship management (BRM) is nowadays regularly named in the top three priorities of CFOs and treasurers alike, along with liquidity decision support and risk management. That is no surprise. Since the financial crisis started, the importance of the financial function within companies has gained further priority – and visibility. This in turn mandates the ability to demonstrate, internally and externally, that one indeed has management control over the bank relationships. That BRM has gained such prominence is explained easily enough if one takes into consideration that financial supervisors and regulators themselves have openly admitted that they “cannot see everything” and that market participants need to take their own responsibilities as well. There is a real supplier risk in the procurement and continued availability of financial products and services that needs to be managed, contrary to prior to the crisis when it was simply assumed any bank would simply always be open for business. ’Risk’ in the bank-client relationship was understood to be unilateral: the bank taking a credit risk on the company. That relationship has now become more balanced. Banks understand the important business value clients represent for them. Clients want to understand and manage the risk from interruption in relationships with their banks because they may not always be able to provide the products and services that the client needs.

We’re conscious of that the fact that Basel III is being implemented, albeit with sometimes apparently local flavours from country to country. The fact that banks need to strengthen the size and quality of their capital buffers has caused a lot of attention to be given to finding alternatives for banks, at least in product areas such as financing. Such solutions can involve capital or money market debt, private placements and peer-to-peer funding. For banks, the advantage could be less usage of their balance sheets whilst earning arrangement fees, thus boosting returns. For companies, it could bring diversification in funding. However, the requirement for increased financial disclosure usually does not sit well with non-public firms, and size and flexibility requirements also pose relevant constraints. And markets can be as unpredictable as financial institutions, necessitating the need for back-stops. Also, past banking crises have often provided only temporary distortions in bank funding.

In all, we are in no doubt, therefore, that banks will continue to be relevant and necessary providers of funding, alongside their role as providers of all the other financial products and services that are essential in the day-to-day operation of any company. Banks will continue to be key suppliers, and thus involve strategic relationships that should be managed in the best way possible.

Sign up for free to read the full article

Register Login with LinkedInAlready have an account?

Login

Download our Free Treasury App for mobile and tablet to read articles – no log in required.

Download Version Download Version